Keep knowledgeable with free updates

Merely signal as much as the International Economic system myFT Digest — delivered on to your inbox.

Three many years in the past I grew to become fascinated by the idea of “social silence” — or the concept superior by intellectuals comparable to Pierre Bourdieu that what we do not discuss is extra necessary than what we do.

Proper now this silence hangs closely over the markets. This week there was a cacophony of terrifying noise round geopolitical occasions — epitomised by President Donald Trump’s warning that America “could or could not” be part of Israel’s assaults on Iran.

And gloomy financial information retains on tumbling out. Final week, the World Financial institution slashed its prediction for international development (to 2.3 per cent) and America (to 1.4 per cent) — warning that if the 90-day pause of Trump’s so-called “liberation day” tariffs expires on July 31, we’ll see “international commerce seizing up within the second half of this yr”. This week the Federal Reserve additionally sharply downgraded its US development projection and raised its inflation forecast. This quantities to stagflation-lite.

But US fairness markets have quietly crept up in current weeks, rising by greater than 20 per cent since early April — recovering from the second they swooned after the “liberation day” tariff announcement. Certainly, they’re near file highs. And whereas 10-year bond yields, at 4.4 per cent, are nearly a share level larger than their ranges final autumn, these have lately stabilised as effectively — whilst US fiscal projections deteriorate.

So the large market “silence” immediately will not be expressions of escalating threat however the seeming lack of investor panic so far.

What’s behind this reticence? One rationalization may lie in what my colleague Robert Armstrong has called the “Taco” effect — the presumption that Trump All the time Chickens Out on his threats. One other is a second “T” drawback: time lags.

The Danish central financial institution, for instance, recently studied how fairness markets have reacted to commerce shocks since 1990. The analysis concluded that whereas “commerce coverage uncertainty [has] vital unfavourable results on financial exercise . . . it takes as much as a yr for the results to materialise”.

Equally, the Financial institution for Worldwide Settlements warned final week that we confronted “a considerable unfavourable contribution of uncertainty to each funding and output development”. Nonetheless, it calculates that the most important influence on funding will happen in 2026 — notice, not this yr — to the tune of a 2 per cent decrease charge of capital expenditure within the US and Japan subsequent yr.

Individually, a slew of analysis has emerged that reveals the diploma to which Trump’s threats to deport thousands and thousands of undocumented staff could hurt the American economy. Whereas raids by Immigration and Customs Enforcement are grabbing headlines proper now, the true financial influence is not going to be seen for a few years. To quote one instance: the Peterson Institute reckons that if 1.3mn migrants had been deported, this could lower GDP by “simply” 0.2 per cent this yr — however by 1.2 per cent in 2028. Therefore the time-lag drawback.

Along with this, there’s a third doable rationalization for the dearth of panic proper now: catastrophe fatigue. Extra particularly, traders face such an overload of disorienting shocks that they’ve (at greatest) change into effectively tailored to dealing with ache, with out panic, or (at worst) are so surprised that they can’t course of it.

Name this, for those who like, the “dying by a thousand cuts” drawback. Proper now, there isn’t a single shock that’s clearly sufficiently big to spark a market crash. Sure, if oil jumps above $100 a barrel amid an additional escalation of the Center East struggle and closure of the Strait of Hormuz, this would definitely damage. And that state of affairs can’t be discounted — least of all, in line with Philip Verleger, an vitality economist, as a result of when Israel’s preliminary assault on Iran started “oil trade companies had been caught with low inventories” and there have been “very giant name positions” (ie by-product bets) that might unwind.

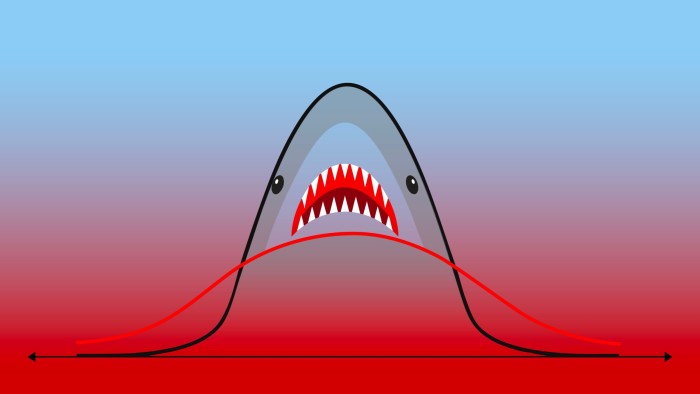

However to date oil costs are “simply” $75 or so a barrel. What traders face immediately is a looming tail threat somewhat than an imminent, tangible catastrophe. Or to make use of one other analogy: markets will not be grappling with a single “coronary heart assault” shock (as in the course of the Covid-19 pandemic) however a spreading financial most cancers, within the type of metastasising uncertainty round future damage. This isn’t 2020.

Therefore the transient explosions of market volatility — as measured by the VIX index — which then die down. That is additionally the rationale why the message from completely different asset courses will not be constant. “US equities are behaving like Trump, chasing short-term wins,” says Jack Ablin, chief funding officer of Cresset. “Lengthy bonds are performing like [Elon] Musk, fixated on longer-term, uncomfortable truths.”

And right here we come again to the issue of social silence. As traders attempt to parse the complicated tail dangers, most are beset with profound doubts — and to a level that leaves even professionals feeling nervous if not embarrassed. Which means it may not take a lot for fairness markets to crack; nevertheless it additionally implies that nobody is aware of when (or if) this may happen. Generally it’s certainly the silence that screams loudest of all.