This text was produced for ProPublica’s Native Reporting Community in partnership with Tennessee Lookout . Sign up for Dispatches to get tales like this one as quickly as they’re printed.

ProPublica and the Tennessee Lookout are persevering with to analyze Harpeth Monetary, which owns Flex Mortgage operator Advance Monetary and on-line sportsbook Motion 247. To inform us in regards to the expertise you had with both or each corporations, name or textual content reporter Adam Friedman at 615-249-8509.

Jeanette Thomas had simply made her first cost on a mortgage from payday lender Advance Monetary when she stated the corporate emailed her with “excellent news.” She might borrow $206 extra.

The solicitation was a reduction to Thomas, a 62-year-old grandmother who had already exhausted the $783 incapacity test she receives every month since her well being circumstances render her unable to work.

Over the following few months, Thomas made the required minimal funds on what began in 2019 as a $400 mortgage to purchase Christmas presents. However every time she did so, the corporate invited her to borrow nearly the entire cost again, she stated, with emails or letters like “Entry Your Money At the moment” or “You’re Already Authorised.”

“They stored making an attempt to rope me in,” Thomas stated.

Within the months that adopted, the corporate continued to develop her credit score, permitting Thomas to borrow near $1,600 in whole. Within the emails and letters that Thomas stored, Advance by no means said how a lot it could value if she continued to reborrow.

Thomas had learn her unique mortgage paperwork warning that the mortgage carried a excessive 279.5% rate of interest and could be difficult to repay. However because the mortgage stability grew, Thomas got here to comprehend she was trapped. By the spring of 2021, Thomas had paid Advance nearly $4,000, but she nonetheless owed greater than $1,000 and was paying greater than $200 a month to cowl the curiosity, depleting the incapacity checks that had been her solely supply of earnings.

Till the Flex Mortgage, reborrowing or rolling over payday loans was towards the legislation. Tennessee lawmakers first banned reborrowing after they handed the state’s payday lending legislation in 1997. They reaffirmed that safety in 2011 after they up to date that legislation.

When Tennessee lawmakers handed a 2014 legislation permitting Flex Loans, they included no such provision.

As an alternative, the invoice’s sponsor, present Home Speaker Cameron Sexton, stated the loans might be higher for debtors as a result of it required them to make a month-to-month minimal cost that lined all charges, curiosity and three% of the principal. This key provision would be sure that debtors would at all times be paying down the principal on the mortgage.

Thomas and greater than a dozen debtors instructed the Tennessee Lookout and ProPublica that Advance has inspired them via emails and notifications to borrow again the worth of virtually the entire funds they made, tearing a gap within the security internet the legislation tried to place in place.

All however one of many 14 debtors who spoke to the newsrooms for this story reported having reborrowed not less than as soon as as a part of their Advance mortgage. As with Thomas, Advance made them eligible to borrow extra shortly after paying, though they had been typically making the minimal funds and nearly instantly borrowing the cash again to cowl the price of the cost they simply made. Advance went on to sue 12 of those debtors as soon as they stopped having the ability to afford the mortgage.

Credit score:

Obtained by Tennessee Lookout and ProPublica. Highlighted and redacted by ProPublica.

Andrea Heady, 45, was sued by Advance in Knoxville for over $7,300, regardless of having paid the corporate almost double what she finally borrowed. She initially took out $750 via a Flex Mortgage after the hours at her college job had been slashed in June 2020.

“I’ve at all times despatched cash residence to my mother,” who was taking good care of Heady’s sister, she stated. “It was COVID. My aunt and uncle had been very sick, then they handed away and I simply wanted cash.”

Heady stated Advance would ship her notifications letting her know she might borrow extra. One electronic mail appeared as a monetary assertion, however included in daring and huge textual content was the quantity she had accessible to borrow. The assertion didn’t present a cost schedule, a brand new mortgage quantity, the entire value of the mortgage or how lengthy it could take to repay making minimal funds, info a lender would have been required to offer if she’d been borrowing on a bank card.

Credit score:

Stacy Kranitz for ProPublica

Heady reborrowed on her Flex Mortgage over a dozen occasions over the following 18 months as Advance elevated her credit score restrict seven occasions. She stopped paying when her month-to-month funds of $650 equaled 1 / 4 of her paycheck.

Heady hoped the corporate would neglect about her, but it surely didn’t. In 2024 Advance sued and received a wage garnishment towards her. In the end, Heady will find yourself paying Advance over $14,000 on the $3,850 she borrowed.

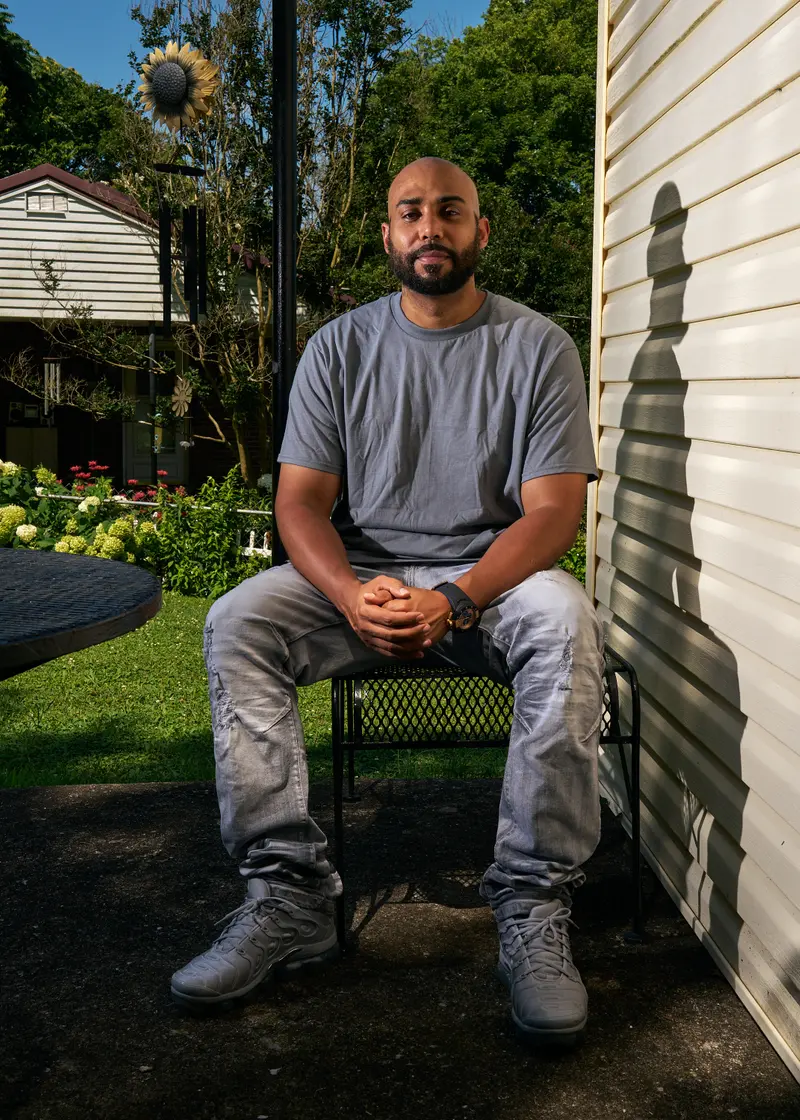

David Hill, a 36-year-old from Nashville, began by borrowing $175 from Advance in February 2020. Every month he would repay the total borrowed quantity, together with curiosity and charges, and reborrow the principal, typically on the identical or subsequent day. Over 18 months, he reborrowed nearly 80 occasions.

“COVID occurred and I used to be going via monetary hassle,” Hill stated. “I’d get a test and pay it off. However then I must borrow it again to have cash.”

Credit score:

Stacy Kranitz for ProPublica

By way of electronic mail, Advance stored growing his credit score restrict and inspiring him to borrow extra. “Expensive David,” began two of the emails, which contained notes like “excellent news — you could have $645 accessible.” Hill finally reached some extent the place he couldn’t afford the minimal cost, totaling over $400 a month.

He stopped paying and the corporate sued him in 2023 for over $4,700.

The Lookout and ProPublica despatched detailed inquiries to Cullen Earnest, the senior vice chairman of public coverage at Advance Monetary. Earnest repeated what he stated in a earlier assertion, that the corporate has an A+ score from the Higher Enterprise Bureau. He added that the Tennessee Division of Monetary Establishments has acquired simply 91 complaints about versatile credit score lenders since 2020, representing lower than 0.001% of all new flex mortgage agreements, and that this knowledge displays the satisfaction of the overwhelming majority of Advance’s clients.

The Tennessee Lookout and ProPublica beforehand reported that the corporate has sued over 110,000 Tennesseeans because it started providing the Flex Mortgage in 2015, making it one of many largest single plaintiffs within the state. One of many topics in that story reborrowed on her Flex Mortgage over a dozen occasions, turning $4,400 in borrowed money into greater than $12,500 in funds to Advance. The corporate sued her and received a judgment that led to the garnishment of her wages.

Christopher Peterson, a senior official with the federal Client Monetary Safety Bureau from 2012 to 2016 and a contributor to a number of experiences about payday loans, stated the company sought to restrict reborrowing on payday and title loans as a result of the need to borrow once more typically indicated that debtors couldn’t afford the loans and could be paying them off ceaselessly. That’s very true of the Flex Mortgage in Tennessee, he stated.

“It’s a nasty mortgage,” he stated.

A Higher Mortgage?

The CFPB started concentrating on high-interest lenders in 2013, releasing a report on the hazards of payday loans and the way reborrowing typically led to debt traps.

With the specter of federal regulation looming, Advance Monetary Chairman Michael Hodges began working with Tennessee lawmakers to create a brand new sort of high-interest mortgage that might keep away from federal oversight, he told the Nashville Enterprise Journal.

In Tennessee’s state Home, Advance and different high-interest lenders turned to Sexton to sponsor the laws.

Sexton was then the bulk whip, a place usually reserved for formidable state Home members hoping to journey up the occasion’s ranks. Sexton additionally knew banking. He labored at an area financial institution as a enterprise growth govt, a place he nonetheless holds in the present day, together with having a seat on its board.

Credit score:

John Partipilo/Tennessee Lookout

Beginning within the spring of 2014, Sexton started guiding Flex Mortgage laws via Tennessee’s state Home committees. On the floor, the invoice gave the impression to be a brand new sort of mortgage with a 24% rate of interest, which might be considerably cheaper than the triple-digit curiosity on payday and title loans. However the precise value might be discovered within the invoice’s particulars, which gave lenders the proper to cost a 0.7% every day customary charge, which over a 12 months provides one other 255.5%.

Official video recordings from legislative committee hearings present that neither legislators nor Sexton mentioned reborrowing or the mortgage’s rate of interest.

When Sexton took to the Tennessee Home ground in April 2014, his colleagues confirmed him deference due to his banking expertise, stated former Rep. Craig Fitzhugh, a rural West Tennessee Democrat and the minority chief on the time, who sponsored the unique payday lending laws in 1997.

Through the listening to, Fitzhugh requested Sexton if he thought the soon-to-be-created Flex Mortgage was “a step up for shoppers” in comparison with payday and title loans. Sexton stated that was a “honest assertion.”

When a lawmaker requested in regards to the rate of interest, Sexton stated it was 190% to 210%, which is decrease than the precise fee. However Sexton as soon as once more assured lawmakers that the minimal cost would scale back the price of the mortgage for shoppers.

“Once you cut back the principal every month, clearly you’re lowering the quantity of curiosity,” Sexton stated from the Home ground.

The Flex Mortgage laws handed the Tennessee Home 83-6, with Fitzhugh abstaining from the vote. Fitzhugh stated the high-interest lending panorama in Tennessee has solely “gotten worse” over the previous decade due to Flex Loans.

Rep. Gloria Johnson, a Knoxville Democrat, stated she regrets voting for the Flex Mortgage laws and seems like proponents of the laws misled her.

“I undoubtedly wouldn’t vote that manner in the present day, and want to work to repair that large mistake that’s harm so many Tennesseans,” Johnson stated.

A spokesperson for Sexton didn’t reply to questions from Tennessee Lookout and ProPublica.

Since passing the Flex Loans invoice in 2014, Sexton has acquired over $105,000 in contributions to his marketing campaign and political motion committee from Advance Monetary and its affiliated PACs, making them considered one of his largest contributors.

No Cash for Meals

Over 5 years after the legislation handed, Jeanette Thomas walked into an Advance Monetary retailer three weeks earlier than Christmas 2019 and crammed out an software.

Thomas stated she listed her earnings, gave them her debit card quantity and permission to straight cost her checking account the required month-to-month minimal cost. A borrower isn’t required to place up any belongings, like a automotive or future paycheck, to get a Flex Mortgage.

Credit score:

Stacy Kranitz for ProPublica

In contrast to another debtors, Advance allowed Thomas to pay month-to-month, as a substitute of biweekly, as a result of that’s how she acquired her federal incapacity advantages. Thomas stated she suffered bodily abuse for many years that left her with a traumatic mind damage.

The corporate deposited $400 into her account the identical day she walked into the shop.

On the time of the mortgage, Thomas had been making an attempt to construct a greater relationship together with her two sons and three grandchildren. She used the cash to buy reward playing cards, artwork provides and toys. She was joyful to have the ability to give her household one thing for the vacations.

Thomas’ first minimal cost to Advance was due Dec. 31 and was a manageable $51.78. That December had been chilly, and when Thomas’ warmth invoice got here in $50 greater than regular, she began to fret.

Then, simply two days after her mortgage cost, Thomas stated an unsolicited electronic mail arrived from Advance telling her she was eligible to borrow $206 extra. Thomas thought she might afford it. Why would Advance mortgage her cash she couldn’t pay again, she stated she thought.

What Thomas didn’t notice was her first invoice had solely been for a 13-day cost interval, that means she’d been charged lower than two weeks of curiosity. By taking the extra mortgage for a whole month, her month-to-month cost would nearly triple to $130 per 30 days.

Over the following two months, the corporate provided her a lifeline, extending her credit score restrict sufficient that she might make her funds with the cash she’d simply borrowed.

Finally, Advance stopped growing her credit score restrict and her month-to-month cost had elevated to $230 a month, nearly a 3rd of her incapacity test.

Thomas minimize her spending to the bone, hoping that just a few months of funds would get her out of debt. She turned to buddies to assist pay for meals, and to an area church to cowl her utility invoice.

Thomas stated Advance despatched her mailers and emails a number of occasions a month, providing to let her borrow any of the principal she had paid off. She tried to withstand, however inevitably, she would have an surprising expense, like medical payments from a sequence of mini strokes.

Thomas discovered herself within the place the CFPB had warned about when it sought to limit reborrowing. Former CFPB official Peterson, who’s now a legislation professor on the College of Utah, helped work on the company’s 2017 payday rules. On the time, the company wrote that buyers who reborrowed would inevitably be pressured to decide on between making an unaffordable cost on the mortgage or paying for requirements like meals or lease.

By Might 2021, Thomas might now not afford to pay. The corporate stored her mortgage open and unpaid for 90 days, permitting the curiosity and charges to build up, almost doubling the quantity on account of $1,700. Advance then charged Thomas two occasions in a single week, withdrawing $430, or half of her month-to-month funds.

“I can bear in mind simply mendacity in my mattress, abdomen hurting and doubled over in ache as a result of I couldn’t get one thing to eat,” Thomas stated.

Not figuring out the place to show for assist, Thomas filed a criticism with the Tennessee legal professional normal’s Division of Client Affairs. In her criticism, she wrote that Advance “must cease abusing their energy.”

“Now I can’t pay my lease,” she stated.

The state investigated the case and took no motion. By October 2022, Advance famous on considered one of Thomas’s month-to-month payments that it had “written off” her mortgage and closed her account. In contrast to the opposite 110,000 Tennesseans who fell behind of their funds, Advance hasn’t sued Thomas, whose federal advantages are shielded from garnishment.

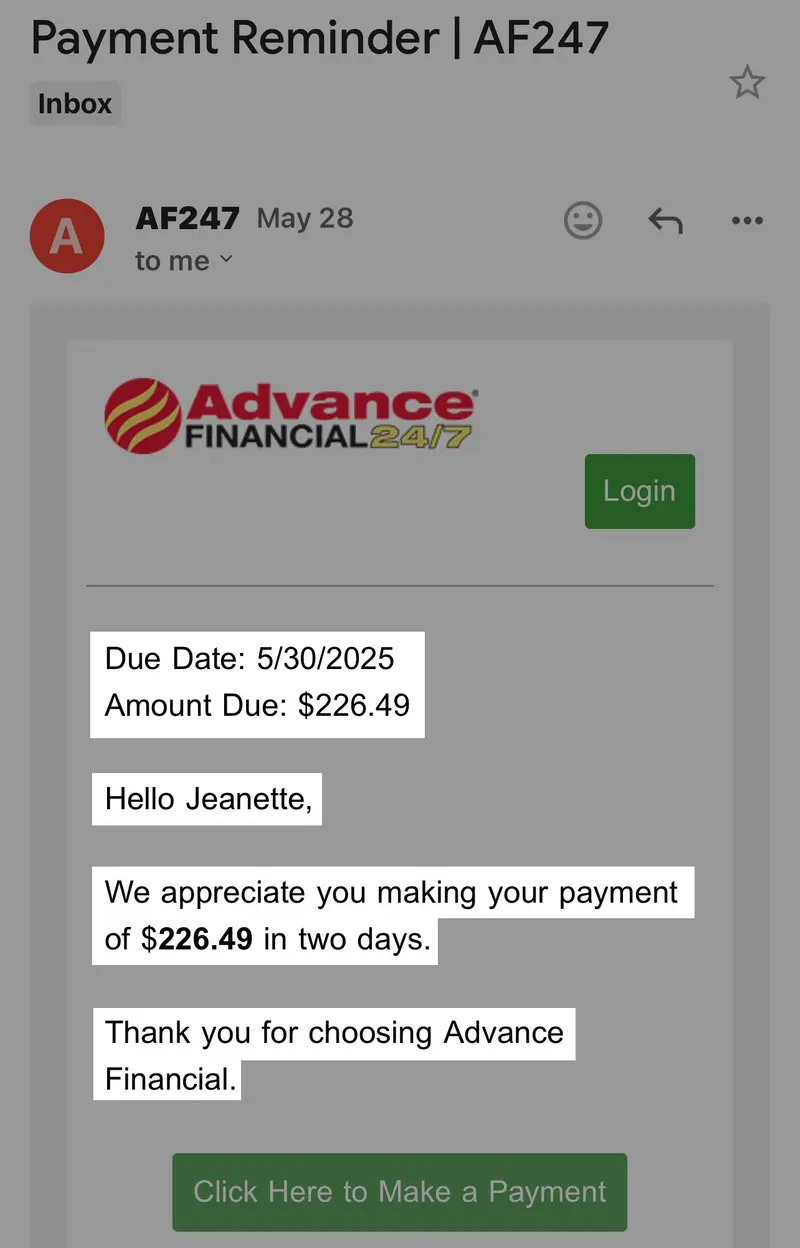

The corporate additionally agreed in a letter to the state to “stop all communications” with Thomas, however Advance continues to ship payments requesting a minimal cost of $226.49.

Credit score:

Obtained by Tennessee Lookout and ProPublica. Highlighted by ProPublica.

Mollie Simon contributed analysis.