In Born in Flames, Bench Ansfield asks, who, or what, is answerable for the arson epidemic that the borough within the Seventies and ’80s?

Nighttime view of individuals in a vacant lot as they watch a fireplace burning on the highest flooring of an condo constructing within the Bronx, New York, 1983.

(Ricky Flores / Getty Photographs)

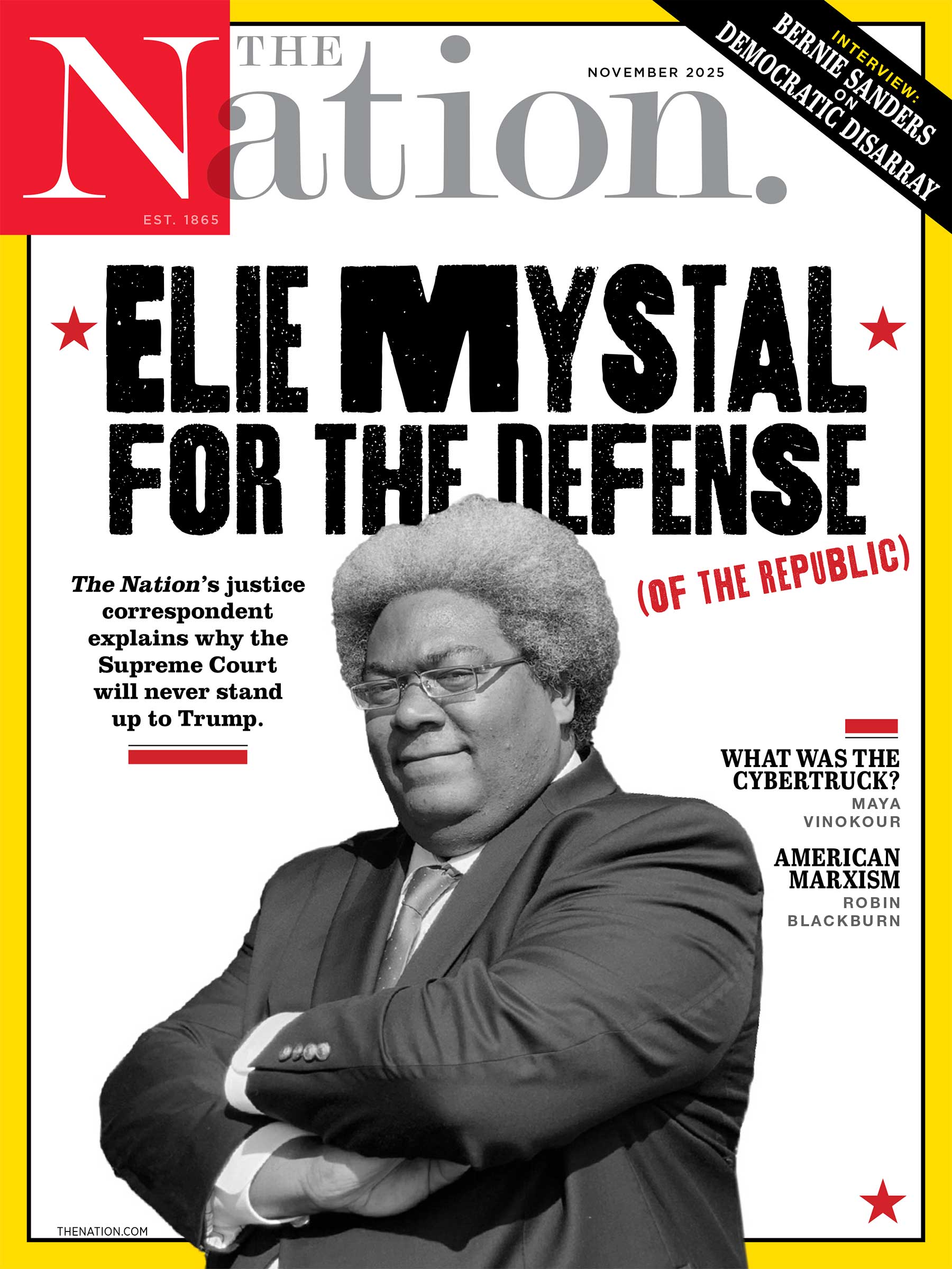

Few photos from the Seventies nonetheless resonate like these of the destruction of the Bronx. Block after block of once-doughty condo buildings, deserted and burned; entire streets, even neighborhoods, left strewn with charred stays and blackened ruins; only a few church buildings, storefronts, or different survivors spiking up from the fields of rubble. Scenes like this—repeated throughout New York and different postindustrial cities—stood in for the very thought of the Bronx, simply because the identify of the beleaguered borough served as a synecdoche for the entire thought of city decay. Half a century on, such scenes have change into a form of inventory repository of metropolis clichés, requiring the compulsory comparability to Dresden or Hiroshima, in addition to the relentless “the Bronx is burning” memes. However all alongside, some elementary questions have gotten misplaced or obscured within the haze surrounding spoil porn, or in mass forgetting and its handmaiden, pre-gentrification nostalgia: How precisely did this occur? What set the Bronx burning?

Books in assessment

Born in Flames: The Enterprise of Arson and the Remaking of the American Metropolis

Frequent solutions to those questions are likely to stumble out, bleary-eyed, from the identical fog of defective reminiscence. It was arsonists of some sort—bored and lawless youngsters, perhaps , or the borough’s infamous avenue gangs. Or it was vandals bent on harvesting metals from the blitzed ruins of torched flats. Typically it was welfare cheats, too—households who burned down buildings to get metropolis relocation funds and new flats. Or perhaps it was simply negligence, the consequence of a cigarette left burning or an oven left on. Pushed mad by deprivation and chaos, Bronxites misplaced all sense and burned their very own neighborhoods down. They did it to themselves.

A few of these issues did occur. However in numbers massive sufficient to ship such pervasive devastation? No, that’s absurd; it is senseless. Twenty p.c of the Bronx’s housing inventory burned—over 100,000 items—and fires additionally claimed huge acreage in different American cities. Solely racism underpins the defective logic of such claims.

The reality is that a lot of the fires have been set or commissioned by landlords. However why would they burn down their very own property? Fifty years in the past, neighborhood organizers, journalists, firefighters, native politicians, regulation enforcement, and municipal and federal investigatory commissions uncovered the reply. For the historian Bench Ansfield, whose Born in Flames returns us to the scene of those crimes, the first wrongdoer is each banal and all-encompassing—insurance coverage.

“We knew that arson was for revenue,” recalled Genevieve Brooks, the founding father of the Mid-Bronx Desperadoes, one of many first community-development organizations that attempted to douse the flames. “It wasn’t {that a} junkie went to sleep in a constructing…it was a wholesale enterprise for everyone. The landlords collected…from the insurance coverage firms.” Even so, the query stays: How may this occur?

The puzzle that Ansfield items collectively started in 1968 with the Truthful Entry to Insurance coverage Necessities program, an obscure little bit of civil-rights-era federal coverage. Designed to counter the “insurance coverage redlining” that unfolded when huge personal insurers withdrew protection from landlords and companies in riot-scarred city neighborhoods, FAIR insurance coverage sought to backstop the personal insurance coverage market with authorities funds.

FAIR plans stored landlords solvent and concrete property markets alive, however additionally they featured excessive charges—4 to 5 occasions better on common than the common market—and inferior protection. Market-rate insurance coverage calculated its charges from industry-wide swimming pools, dispersing the danger. However FAIR plans, the insurance coverage underwriters argued, have been taking up the sorts of dangerous danger that ought to be sequestered from the remainder of the {industry}. These plans based mostly their charges solely on swimming pools of comparable FAIR properties—which, being in high-risk areas, carried better prices and defaults. As Ansfield writes, years of city segregation and deprivation had bred new types of monetary discrimination—it was “Jim Crow, insurance-style.”

Nonetheless, FAIR insurance coverage rushed in to fill the hole left by the retreat of conventional insurance coverage, which disappeared together with jobs, capital, and social providers. Even when FAIR charges have been based mostly on a segregated pool, the losses can be distributed throughout all of the insurers participating in this system—that means that nobody firm would really feel the ache. And so, at the same time as losses skyrocketed all through the fire-ridden ’70s, particular person insurance coverage firms invested closely in FAIR plans: underwriting insurance policies on beleaguered city actual property at inflated valuations, passing on the mounting losses to policyholders within the type of larger premiums, shopping for insurance coverage on their very own insurance coverage insurance policies (so-called “reinsurance”), and paying out on claims with little investigation into the causes.

All of this was redoubled, too, by a flip towards the financialization of insurance coverage. The place insurance coverage firms had as soon as made cash solely on underwriting—fastidiously calibrating the danger of losses to the quantity of premiums collected—by the ’70s they have been more and more turning to monetary markets, and the period’s excessive insurance coverage charges, to ensure earnings. Premiums turned capital to be invested in shares and bonds. Even because the underwriting losses jumped, revenue may nonetheless be discovered so long as the corporations stored amassing premiums and turning them over on Wall Avenue. The businesses noticed this as a win-win scenario: earnings for them, capital to assist the growth of underwriting, and contemporary streams of money to pay out on the mounting claims from their FAIR enterprise.

Ansfield calls the entire course of “insurance coverage brownlining”—the results of attempting to reply insurance coverage redlining with a poorly regulated inexperienced mild for costly, subpar insurance policies hopped up on hypothesis and inflated values. If the insurers had been incentivized to show a blind eye to their very own losses, their actions set in movement an altogether extra perverse and tragic sequence of incentives for a lot of of their policyholders in neighborhoods just like the Bronx.

City landlords had at all times existed on tight margins, utilizing rents to maintain their buildings afloat. However the revenue on rental properties lay much less in lease than in fairness. As Homefront, a Seventies tenant and housing-research group, confirmed in a report on the causes of housing abandonment, the true worth of an city property lay in its saved capital—revenue that was realizable provided that it may very well be remortgaged or offered. But as banks redlined locations just like the Bronx, and property values dipped moderately than surged, these offers turned much less and fewer worthwhile—and even attainable. When the landlords’ “hopes of future acquire are dashed,” the Homefront researchers wrote, they lose their enterprise mannequin. They usually fell behind on taxes and repairs, “milking” buildings for money and exploiting tenants till they might promote or discover one other option to get out from underneath.

That is the place the excessive charges and inflated valuations reduce deepest. Landlords discovered themselves with declining buildings and rising upkeep prices, but in addition spiking insurance coverage premiums and out-of-balance valuations. Capital was not saved in actual property, however moderately in insurance coverage. Landlords tipped over into what Ansfield calls the “insurance coverage hole”—the ethical void that opened between the excessive insurance coverage valuation and the cratering market worth of their property. For a lot of landlords, the choices have been stark and ugly: grasp on, exploiting your tenants and hemorrhaging cash; reduce your losses in a fireplace sale; abandon the constructing; or flip to fireside itself to recoup your funding with an insurance coverage declare.

Well-liked

“swipe left beneath to view extra authors”Swipe →

The Bronx’s landlords have been principally small-time capitalists, usually Jewish and typically Italian American, with roots within the borough’s pre–World Conflict II working class. Many have been additionally absentee landlords—they’d adopted their neighbors out to the suburbs within the postwar years. Their connections to the now Black and Puerto Rican neighborhoods they’d left behind had waned and infrequently soured, exacerbating the already highly effective monetary incentives to deal with tenants instrumentally moderately than humanely. Brownlining and the insurance coverage hole shredded these frayed ties and led many landlords to take the direst of paths. They employed “torches”—most frequently younger locals trapped in what Ansfield aptly calls “the ambivalence and anguish of survival work”—then issued surreptitious warnings to tenants (or not, in lots of instances) earlier than their paid arsonists touched off a blaze within the high story, the place it could do sufficient injury to make an insurance coverage declare viable however endanger the fewest lives.

A lot of the Bronx’s devastation went like this: landlord by landlord, fireplace by fireplace, with the perverse incentives spreading as quick because the flames themselves. However these incentives ultimately attracted larger fish. By the center of the last decade, entire arson rings had sprung up, launching conspiracies between landlords who had purchased up a number of buildings and shady webs of transnational insurance coverage pursuits. Ansfield traces the story of 1 circuit of capital—uncovered by federal investigators within the Seventies—from the Bronx, the place an area insurance coverage dealer wrote substandard insurance policies for legal landlords bent on amassing post-blaze payouts; to Florida, the place a fly-by-night underwriter backed his Bronx affiliate; to London, the place a rogue Lloyd’s of London companion ran a syndicate that specialised in dangerous and unethical insurance policies; to Brazil, the place Lloyd’s purchased reinsurance on the bundled insurance policies, distributing its danger to a Rio de Janeiro agency. At each step on this unholy chain, crooks and their cronies—witting and unwitting—discovered themselves able to rake in earnings from a predatory system that ensured everybody turned a blind eye to the destruction of the very locations that “insurance coverage” was supposed to guard.

Particulars like this spill out from scene after scene of Born in Flames. Ansfield has labored arduous to herd the outcomes of their prodigious analysis into line, wrangling a recondite and knotty story of insurance-policy trivialities, monetary chicanery, and obscure municipal-commission historical past into form, whereas gamely attempting to throw a rope round all method of loosely associated ephemera, from the acquainted (references to disco and early hip-hop or the origins of “damaged home windows” criminology) to the much less anticipated (the vogue for the thought of “burnout” in pop psychology). Not all of this fairly lands—it’s tough to inform what particular underlying dilemmas of the hearth years emerge from the idea of “burnout” or the Trammps’ radio hit “Disco Inferno.”

The place it does resonate—within the evaluation, for example, of the protests over the Paul Newman movie Fort Apache, the Bronx (1981) and its depictions of the borough’s struggling—Ansfield’s power tends to come up from the individuals of the Bronx and their expertise of the burning years. Insurance coverage brownlining and its discontents come alive within the tales of households startled awake by firebombs within the evening, or the traumatized renters, displaced a number of occasions, who turned practiced within the artwork of fleeing fireplace. These tales put flesh on the bones of the arson rackets. Additionally, the youngsters who thrilled and despaired on the sight of fires evening after evening, typically making grim sport of the spectacle even because the flames crept towards their very own houses, or the handymen confronting the ethical disaster of signing on as “torches”—their accounts give the e-book its recurring thread and maintain readers attuned to the ways in which finance and coverage affect individuals’s lives and neighborhoods.

In the end, Ansfield reserves satisfaction of place for the organizers and residents who banded collectively to battle again. Finally, painstakingly, group teams launched analysis initiatives to show the assorted arson-for-profit schemes and goad politicians and police right into a crackdown. In addition they began the earliest “sweat fairness” teams to avoid wasting buildings and the community-development companies to erect new housing. Over the course of the ’70s, metropolis officers and law-enforcement businesses lastly started to take discover of the group outrage, and a sequence of municipal and federal investigations dug up the small print. New laws adopted, and the burning years tapered off by the Eighties.

What does this historical past inform us? If it wasn’t a season of insanity, then what was it? Orthodox neoliberals may recommend that it was all the federal government’s fault: The FAIR program’s interference corrupted market effectivity, establishing “ethical hazards” for everybody that led to the evils that Ansfield chronicles. This has a seductive logic; it’s actually what many landlords believed. They’d lengthy campaigned in opposition to metropolis controls on rents, which they maintained threatened their livelihoods and would inevitably result in deterioration and abandonment. However they might not clarify why this was so within the South Bronx and never on the Higher West Aspect, Ansfield notes, or in different components of the town the place landlords chafed underneath lease controls however loved earnings nonetheless.

In the meantime, public housing hardly ever, if ever, burned. There was no revenue in it, and so the numerous New York Metropolis Housing Authority initiatives dotting the Bronx continued to supply spots of calm in a panorama flaring with the embers of nightly blazes. Shelley Sanderson, who grew up within the South Bronx’s Saint Mary’s Park Homes, remembered frequent and scary fires burning within the buildings throughout Cauldwell Avenue however by no means in her personal growth. Throughout New York Metropolis in 1977—on the top of the burning years, when virtually 170,000 households lived in public housing—a Bronx district legal professional discovered that the town reported no important structural fires in its a whole bunch of buildings. The roots of the city deprivation that led to the hearth years lay not in authorities motion alone, however within the particular ways in which personal capital and public energy mixed to favor sure components of the metropolis over others. The place authorities intervention had harmed the town’s vitality—as within the historical past of redlining—it was by means of perpetuating the discriminatory development and growth pioneered by the personal actual property {industry}.

The function of insurance coverage in setting the town alight pulls again the curtain on numerous bigger, enabling structural circumstances. As Ansfield explains, regardless of the very actual existence of particular person and collective collusion to burn buildings and acquire payoffs, arson for revenue was greater than a conspiracy. The fires have been as an alternative proof of a widespread complicity, on the a part of landlords and insurers, with two bigger forces—financialization and racial capitalism—that shapes the system of personal property.

“What seems as a wasteland within the Bronx could also be an appropriate loss within the board rooms of London or Decrease Manhattan,” wrote two arson researchers for this journal in 1986, surveying the wreckage after the fires receded. Much less understood, maybe, is the outright dependence of revenue on seen and scandalous destruction, so long as it may be defined away with the straightforward con of racism.

Insurance coverage is a crucial a part of economies based mostly on danger: It spreads the hazards round, supporting capital funding in property and total financial development. What to make, then, of a scenario wherein insurance coverage incentivized the destruction of property, of so-called capital inventory—the very constructing blocks of accumulation? Born in Flames argues that this paradox is defined by the truth that insurance coverage can also be at all times implicated within the perpetual entanglement of profit-seeking and racism, shoring up an American property system that has lengthy delivered acquire and safety for white individuals, whereas placing communities of coloration at better moderately than lesser danger. By these lights, the FAIR plans touched off a very devastating spherical of what Keeanga-Yamahtta Taylor has referred to as “predatory inclusion”: They promised restored entry to protection however delivered inferior insurance coverage on unequal phrases that redoubled discrimination and inspired arson for revenue. This impact was exacerbated by post-Sixties finance and its encouragement of “the buying and selling of cash over the buying and selling of products,” as insurance coverage firms shifted their consideration from group well-being to Wall Avenue hypothesis, making premiums a measure of extraction moderately than native funding.

That is convincing, insofar as one accepts the analytic abstraction. What’s fascinating, although, is the way in which Ansfield seems to endorse a number of completely different analytical fashions. From one angle, the issue is simply enterprise as normal—the persevering with manner that racial division stratifies society, producing the winners and losers required for capitalist profit-making, a course of that hyperlinks the burning Bronx again to housing discrimination, Native dispossession, empire, and slavery. Alongside the way in which, this overarching drive meets financialization’s periodic and perverse mutation of capitalism’s pursuits in fueling development and prosperity. Nevertheless, in different moments, Ansfield seems to endorse the alternative thought: that trendy capital accumulation at all times takes the type of finance, squeezing the arduous stuff of life into the cells of a spreadsheet after which setting it unfastened in the marketplace to be traded, the place it can inevitably be yoked to unequal exploitation. Finance is both a frontrunner or a follower, and insurance coverage is both an accelerant—the accent to periodic bouts of malfeasance—or the common protector of normal monetary predation.

Turning this advanced spherical and spherical to search for linear causation could also be inappropriate: Relying on the place one seems to be, there are sure to be tensions within the particulars. One may fairly object, for example, that each the FAIR plans and common market insurance coverage turned fodder for hypothesis, elevating the query of how financialization was significantly yoked to racial capitalism. Landlords seem as each unlucky cogs within the machine and the rapacious reapers of “huge fortunes” at completely different occasions within the e-book. The FAIR plans is likely to be emblems of civil-rights achievement or an try at “co-opting” the motion’s power. As complete as this technique may seem, some may argue that what Ansfield truly reveals is how the common processes of reform—agitation, investigation, and regulation—undid arson for revenue. By these lights, the fires have been native tragedies, the product of a nationwide city disinvestment that may very well be and ultimately was circled and sorted out, even because the bigger forces of city inequality that produced them continued unabated.

However for Ansfield, that’s exactly the purpose: The teachings of the burning years nonetheless echo. “The world wherein a solidly constructed dwelling may generate extra worth by ruination than habitation is identical world wherein homelessness, eviction, and foreclosures have change into defining points of city life,” they write. Typically evidently the final word villain of Born in Flames is personal property itself. This, too, soars excessive above the messier particulars of the Bronx. Public housing managers might have escaped the merciless decisions that led the borough’s landlords to the torch, however they’ve at all times needed to wrestle with circumstances and incentives that may result in common and ongoing negligence. Likewise, when Ansfield turns to the makes an attempt to rebuild the Bronx, they distinguish between sweat fairness (neighbors banding collectively to cooperatively rebuild and personal buildings) and community-development companies—nonprofits that constructed new inexpensive housing, changing into landlords themselves. Ansfield prefers what they see as sweat fairness’s “imaginative and prescient of a Bronx with out landlords” over the CDC mannequin, which “enshrined personal property.” This downplays the truth that each efforts made prepared use of long-standing beliefs of particular person property possession—common for generations within the US and reinvigorated in an period of rising neoliberalism—however did so within the identify of communal caretaking for neighborhoods and shared group life. Each had their successes and failures, and each supply helpful sources—as does the outright public possession of housing.

If there’s one clear lesson we will draw from this historical past, it’s that we have to reimagine the actual type of personal property that underpins city life in the USA. This technique relies on what the urbanist Jane Jacobs referred to as a “monstrous” public-private hybrid, one which mobilizes social divides to propel acquire right here or to repair neglect and devastation there. Studying from the Bronx organizers and residents who put cooperative, participatory beliefs to work—undoing the inducement to cull revenue from destruction in every single place—is nearly as good a spot as any to begin.

Extra from The Nation

He’s abusing his workplace to drive cultural establishments to bend the knee, too—to let MAGA set up its model of our American story at museums, universities, and media firms.

A dialog with Osita Nwanevu concerning the deadly flaws of our governing system, the necessity for a extra egalitarian political economic system, and his new e-book The Proper of the Folks.

The Ellison household’s aggressive pursuit of the WBD empire would shred information values and additional pillage film and TV manufacturing.

A bowdlerized biopic of Bruce Springsteen, starring Jeremy Allen White, flattens a musician whose politics and id are way more sophisticated.

Kate Of us’s Sky Daddy pokes enjoyable on the want for love on the core of most fiction—dramatizing one lady’s quest for love by her very literal lust for airplanes.