By JASON HINES

On August 1, 2025, Capital Girls’s Care (CWC), one of many largest OB/GYN practices within the Mid-Atlantic area went out-of-network with UnitedHealthcare, affecting tens of thousands of women throughout Maryland, Virginia, Pennsylvania, and Washington D.C. The contract dispute between Capital Girls’s Care (CWC) and UnitedHealthcare presents an enchanting case research in how value transparency information can illuminate the true dynamics behind these high-stakes negotiations.

The Public Battle

Capital Girls’s Care, with greater than 250 physicians and healthcare professionals, confirmed that its settlement with UnitedHealthcare would lapse regardless of ongoing negotiations. The follow urged sufferers to contact UHC to voice their issues about shedding entry to their suppliers.

UnitedHealthcare fired again with detailed public claims on their website, alleging that CWC “refused to maneuver off its calls for for double-digit value hikes” and is “considerably larger price right this moment in comparison with peer suppliers all through Maryland and Virginia”. UHC supplied particular examples, claiming {that a} vaginal supply from CWC would price “greater than 120% larger – or over $2,600 extra – than the typical price of different OB/GYN suppliers”.

However what does the precise value transparency information reveal about these competing claims?

What the Transparency Information Exhibits

Utilizing Capital Girls’s Care’s negotiated charges from UnitedHealthcare’s personal machine-readable recordsdata, we analyzed a pattern of widespread OB/GYN procedures from Maryland price information. Whereas this represents solely a subset of all procedures and focuses particularly on Maryland charges, it offers helpful insights into the true fee dynamics between these organizations. The information paints a extra nuanced image than both occasion’s public statements recommend.

Information Methodology Observe: Our evaluation examined negotiated charges for Capital Girls’s Care from publicly accessible machine-readable recordsdata, specializing in Maryland suppliers and filtering out statistical outliers (charges under 50% or above 500% of Medicare). We analyzed charges for each UnitedHealthcare and CareFirst throughout three widespread OB/GYN procedures the place each payers had ample information.

CWC’s Price Place vs Different Payers

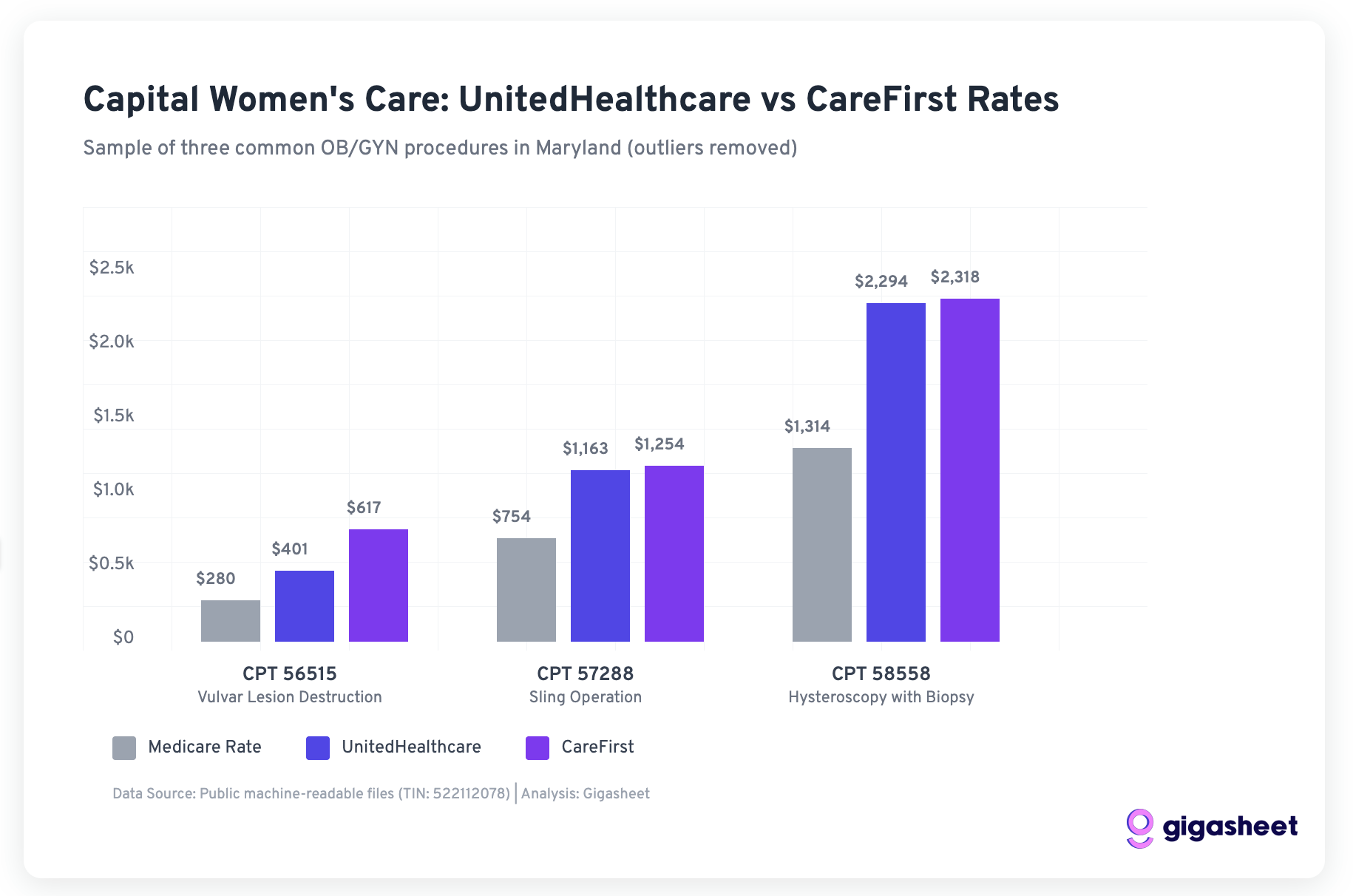

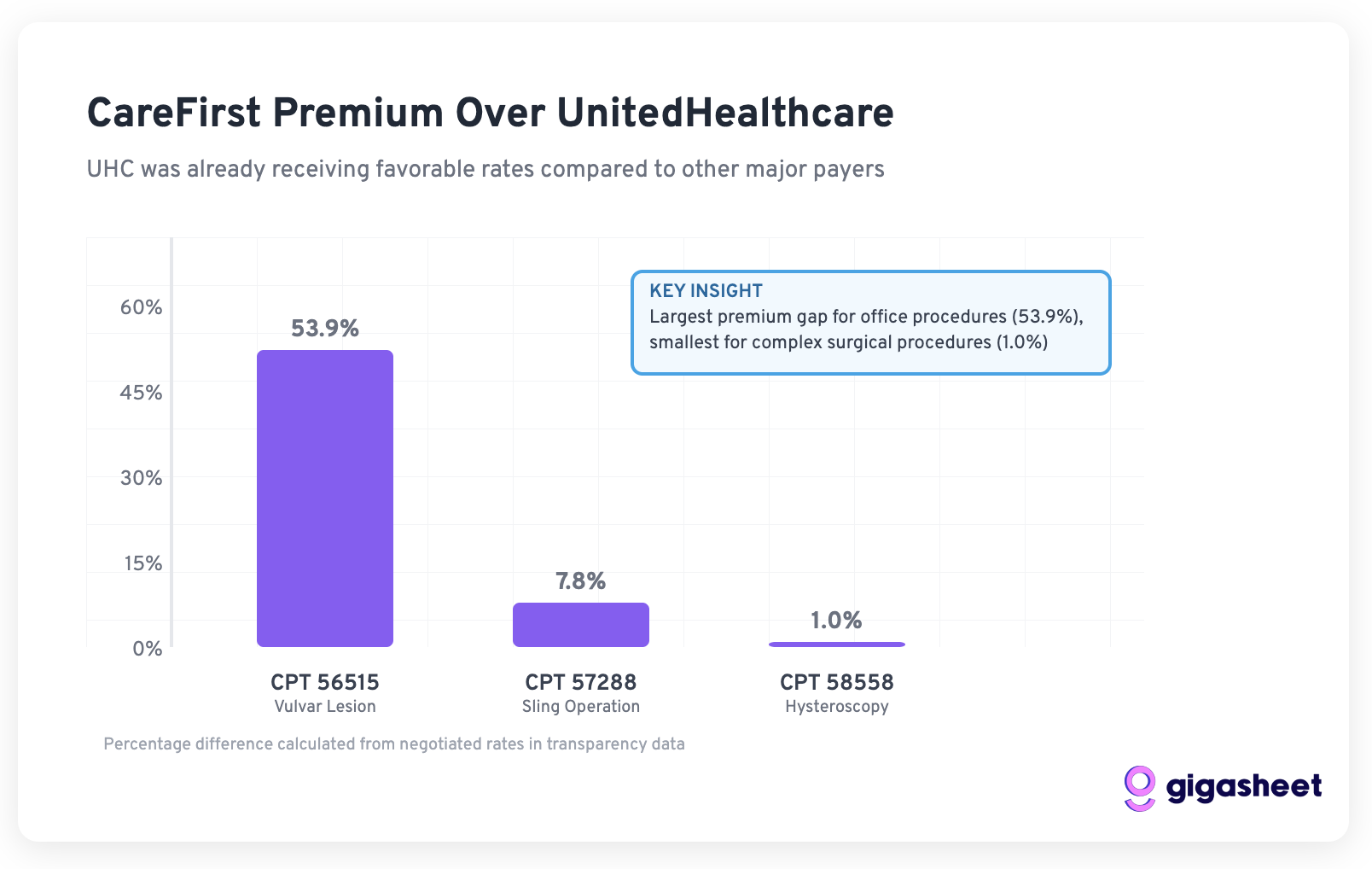

Our evaluation of three widespread OB/GYN procedures in Maryland reveals that CWC’s charges with UnitedHealthcare had been truly fairly aggressive in comparison with different main payers:

For the three procedures the place each UHC and CareFirst have negotiated charges with CWC:

- CPT 56515 (Vulvar Lesion Destruction): UHC paid $401 vs CareFirst’s $617 (53.9% distinction)

- CPT 57288 (Sling Operation): UHC paid $1,163 vs CareFirst’s $1,254 (7.8% distinction)

- CPT 58558 (Hysteroscopy): UHC paid $2,294 vs CareFirst’s $2,318 (1.0% distinction)

This pattern information suggests UnitedHealthcare was already getting favorable charges from CWC in comparison with different main payers, calling into query UHC’s claims about CWC being “considerably larger price.”

The Medicare Benchmark Actuality

Each UHC and CareFirst had been paying CWC charges properly above Medicare in our pattern:

- UnitedHealthcare: 143-175% of Medicare charges

- CareFirst: 166-220% of Medicare charges

Whereas CareFirst paid larger charges, UnitedHealthcare’s charges had been nonetheless substantial premiums over authorities reimbursement, suggesting the “double-digit will increase” CWC requested could have been makes an attempt to align with market charges different payers had been keen to pay.

Vital Limitation: This evaluation is predicated on a pattern of three procedures in Maryland solely. A complete evaluation would require inspecting all process codes throughout all markets the place CWC operates to completely validate these patterns.

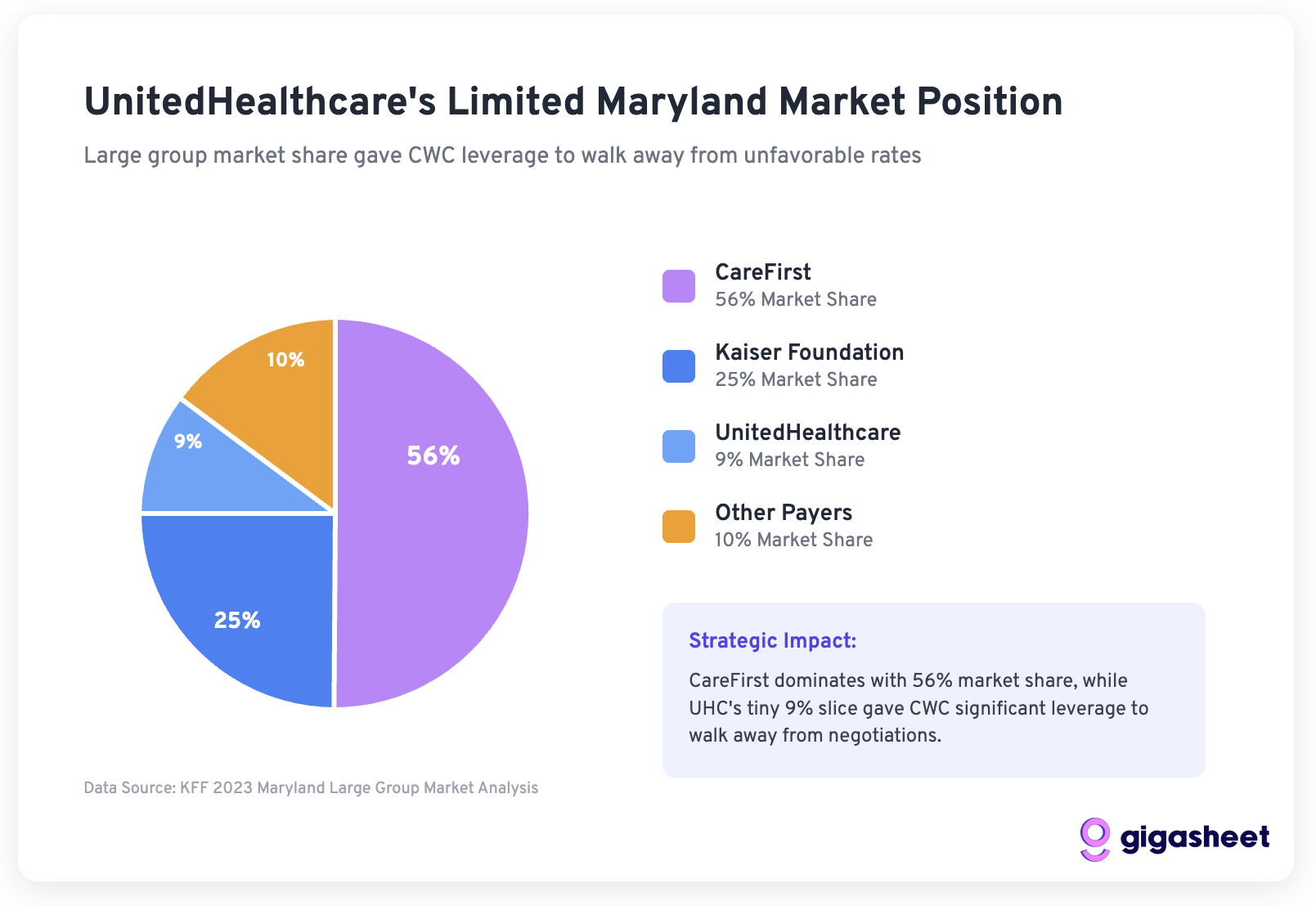

The Strategic Context: Market Share Issues

Understanding why CWC might need walked away requires inspecting UnitedHealthcare’s place within the Maryland market. In keeping with KFF information, UnitedHealthcare holds solely 9% of Maryland’s large group market share as of 2023. This comparatively small market place gave CWC important leverage.

The Math of Strolling Away:

- UHC represents a small portion of CWC’s affected person base

- CWC has contracts with bigger payers (Aetna, CareFirst, Cigna) paying larger charges

- The follow serves over 250 suppliers throughout a number of states

- Strolling away from 9% of the market to ascertain price precedent makes strategic sense

Evaluating UnitedHealthcare’s Public Claims

UHC’s web site makes a number of particular claims that we are able to consider in opposition to transparency information:

Declare 1: “CWC is considerably larger price in comparison with peer suppliers”

Evaluation: Partially Deceptive

Whereas CWC could cost greater than some suppliers, our evaluation reveals UHC was paying aggressive charges in comparison with different main payers for a similar providers. The “peer supplier” comparability lacks context about geographic market charges and supplier high quality variations.

Declare 2: “Double-digit value hikes that will make them 30% larger than common”

Evaluation: Lacking Context

This declare doesn’t account for:

- How UHC’s present charges in comparison with different payers

- Whether or not the “common” contains lower-quality or in another way positioned suppliers

- Regional price variations within the costly Mid-Atlantic market

Declare 3: Particular process price comparisons

Evaluation: Probably Correct however Incomplete

UHC’s claims about supply prices could also be correct, however they don’t present the complete market context. The transparency information reveals important price variation throughout payers and procedures, suggesting that “costly” is relative to the comparability set chosen.

How Worth Transparency Modifications the Recreation

This dispute illustrates how value transparency information is reshaping healthcare negotiations in a number of methods:

Knowledgeable Leverage

Suppliers like CWC can now see precisely how their charges examine throughout payers, enabling extra strategic negotiations. CWC knew they had been giving UHC favorable charges in comparison with CareFirst.

Public Accountability

Each events made public claims that may now be fact-checked in opposition to precise negotiated charges. UHC’s claims about CWC being “considerably larger price” are extra nuanced when considered in opposition to the complete payer panorama.

Market Benchmarking

The transparency information reveals that:

- Regional markets have substantial price variations

- Supplier high quality and market place justify price premiums

- “Costly” is relative to the comparability being made

Strategic Positioning

For a follow with CWC’s market place, sustaining price self-discipline throughout payers turns into essential. Accepting below-market charges from one payer can undermine negotiations with others.

The Actual Winner: Market Transparency

Whereas sufferers are caught in the course of this dispute, the broader healthcare market advantages from the transparency this battle offers. The general public availability of precise negotiated charges means:

- Sufferers could make extra knowledgeable selections about suppliers and plans

- Employers can higher consider insurance coverage plan worth propositions

- Suppliers can benchmark their charges in opposition to precise market information

- Payers should justify price selections with actual information slightly than selective comparisons

Trying Ahead: Classes for Healthcare Negotiations

The CWC-UHC dispute presents a number of classes for future healthcare contract negotiations:

- Worth transparency information is now a negotiating instrument – Either side can and can use precise price comparisons to assist their positions

- Market share issues in price negotiations – UHC’s 9% Maryland market share restricted their leverage in opposition to a big, established supplier

- Public relations battles require information backing – Claims about “costly” suppliers can now be fact-checked in opposition to precise negotiated charges

- Supplier consolidation creates negotiating energy – Giant practices like CWC can afford to stroll away from unfavorable contracts

The Path to Decision

For this particular dispute, the transparency information suggests each events have affordable positions:

- CWC was certainly giving UHC favorable charges in comparison with different payers, justifying their request for will increase

- UHC faces strain to manage prices for members whereas sustaining an satisfactory supplier community

A decision seemingly requires:

- UHC acknowledging that their present charges had been under market

- CWC accepting that dramatic price will increase have an effect on affected person prices

- Each events discovering center floor that displays true market positioning

The provision of precise negotiated price information ought to, in idea, make these conversations extra productive by establishing shared details about market charges and supplier positioning.

Conclusion

The Capital Girls’s Care vs UnitedHealthcare contract dispute demonstrates how value transparency is essentially altering healthcare negotiations. Whereas each events made public claims supporting their positions, our evaluation of precise negotiated price information from Maryland reveals a extra complicated story the place market dynamics, strategic positioning, and regional components all play essential roles.

Key takeaways from our information evaluation:

- UHC was paying aggressive charges in comparison with different main payers for the procedures we examined

- CWC’s resolution to stroll away makes strategic sense given UHC’s restricted 9% Maryland market share

- Each payers had been paying properly above Medicare charges, suggesting room for negotiation

Vital caveats: Our evaluation examined solely three widespread procedures from Maryland information. A complete analysis would require analyzing all process codes throughout all markets the place CWC operates to completely validate these patterns.

As extra stakeholders acquire entry to this beforehand hidden pricing data, we are able to anticipate healthcare contract negotiations to change into extra data-driven, clear, and in the end extra rational. The actual winners shall be those that can successfully analyze and act on this new transparency to make higher selections about healthcare protection, supplier choice, and contract phrases.

I’ll be again on THCB to have a look at the remainder of the context for this dispute partly 2. What was the price of these providers from different suppliers available in the market?

Jason Hines is CEO of Gigasheet which delivers AI-powered value transparency market intelligence.. This was first posted on their corporate blog