Unlock the Editor’s Digest free of charge

Roula Khalaf, Editor of the FT, selects her favorite tales on this weekly e-newsletter.

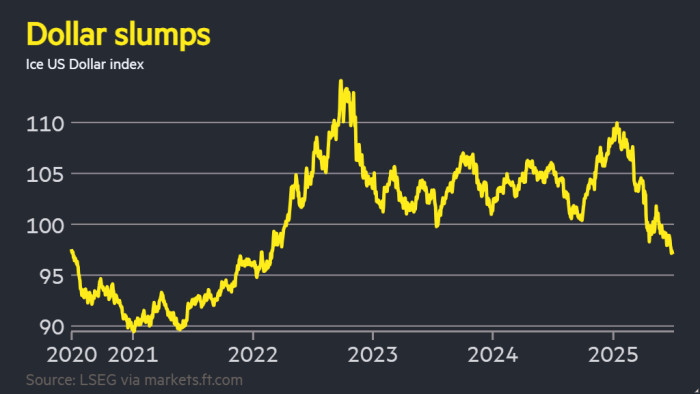

The US greenback is headed for its worst first half of the 12 months since 1973, as Donald Trump’s commerce and financial insurance policies immediate international traders to rethink their publicity to the world’s dominant foreign money.

The greenback index, which measures the foreign money’s energy towards a basket of six others together with the pound, euro and yen, has slumped greater than 10 per cent thus far in 2025, the worst begin to the 12 months because the finish of the gold-backed Bretton Woods system.

“The greenback has turn into the whipping boy of Trump 2.0’s erratic insurance policies,” mentioned Francesco Pesole, an FX strategist at ING.

The president’s stop-start tariff war, the US’s huge borrowing wants and worries in regards to the independence of the Federal Reserve had undermined the enchantment of the greenback as a secure haven for traders, he added.

The foreign money was down 0.5 per cent on Monday because the US Senate ready to start voting on amendments to Trump’s “huge, lovely” tax invoice.

The landmark laws is anticipated so as to add $3.2tn to the US debt pile over the approaching decade and has fuelled considerations over the sustainability of Washington’s borrowings, sparking an exodus from the US Treasury market.

The dollar’s sharp decline places it heading in the right direction for its worst first half of the 12 months since a 15 per cent loss in 1973 and the weakest exhibiting over any six-month interval since 2009.

The foreign money’s slide has confounded widespread predictions initially of the 12 months that Trump’s commerce conflict would do higher harm to economies exterior the US whereas fuelling American inflation, strengthening the foreign money towards its rivals.

As a substitute, the euro, which a number of Wall Road banks have been predicting would fall to parity with the greenback this 12 months, has risen 13 per cent to above $1.17 as traders have targeted on development dangers on the planet’s greatest financial system — whereas demand has risen for secure property elsewhere, resembling German bonds.

“You had a shock when it comes to liberation day, when it comes to the US coverage framework,” mentioned Andrew Balls, chief funding officer for international mounted earnings at bond group Pimco, referring to Trump’s “reciprocal tariffs” announcement in April.

There was no important menace to the greenback’s standing because the world’s de facto reserve foreign money, Balls argued. However that “doesn’t imply that you could’t have a big weakening within the US greenback”, he added, highlighting a shift amongst international traders to hedge extra of their greenback publicity, exercise which itself drives the dollar decrease.

Additionally pushing the greenback decrease this 12 months have been rising expectations that the Fed will minimize charges extra aggressively to help the US financial system — urged on by Trump — with no less than 5 quarter-point cuts anticipated by the tip of subsequent 12 months, in keeping with ranges implied by futures contracts.

Bets on decrease charges have helped US shares to shake off commerce conflict considerations and battle within the Center East to achieve document highs. However the weaker greenback means the S&P 500 continues to lag far behind rivals in Europe when the returns are measured in the identical foreign money.

Huge traders from pension funds to central financial institution reserve managers have acknowledged their need to scale back their publicity to the greenback and US property, and questioned whether or not the foreign money remains to be offering a haven from market swings.

“Overseas traders are requiring higher FX hedging for dollar-denominated property, and that has been one other issue stopping the greenback from following the US fairness rebound,” mentioned ING’s Pesole.

Gold has additionally hit document highs this 12 months on continued shopping for by central banks and different traders anxious about devaluation of their greenback property.

The greenback stoop has taken it to its weakest degree towards rival currencies in additional than three years. Given the pace of the decline, and the recognition of bearish greenback bets, some analysts count on the foreign money to stabilise.

“A weaker greenback has turn into a crowded commerce and I believe the tempo of decline will sluggish,” mentioned Man Miller, chief market strategist at insurance coverage group Zurich.