The US Federal Reserve has left its benchmark charge unchanged regardless of mounting stress from President Donald Trump to chop charges.

On Wednesday, the Fed mentioned it would depart its short-term charge regular at 4.25 p.c to 4.5 p.c.

The central financial institution’s choice was largely in keeping with expectations, and it has not reduce rates of interest since December.

The choice comes as policymakers weigh indicators of a weakening economic system. US retail gross sales numbers fell greater than anticipated in its report from the US Division of Commerce yesterday. Final week’s jobless claims report from the US Division of Labour got here in at its highest in eight months at 248,000.

Nonetheless, the last jobs report confirmed the unemployment charge was regular at 4.2 p.c, indicating the labour market, whereas slowing, stays pretty secure.

“The Committee seeks to realize most employment and inflation on the charge of two p.c over the longer run. Uncertainty in regards to the financial outlook has diminished however stays elevated,” the central financial institution mentioned in a press release.

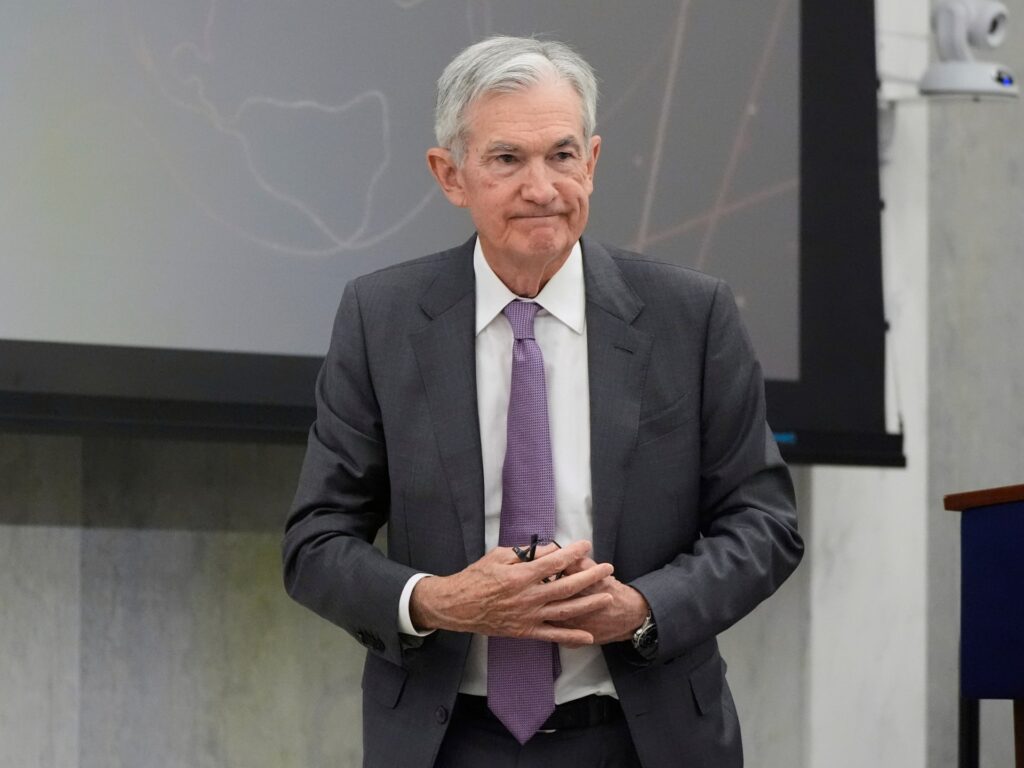

Powell identified the labour market was not a supply of main inflationary pressures, and that the central financial institution was holding charges regular to reply to uncertainty pushed by Trump’s financial and immigration insurance policies in addition to client costs, a key inflation gauge for the Federal Reserve. The newest report confirmed a 2.1 p.c enhance for the month of April.

“We’ve seen items inflation shifting up a bit,” Powell mentioned. “We do count on to see extra of that through the course of the summer season. It takes time for tariffs to work their method by means of the chain of distribution to the tip client. We’re starting to see results and we do count on to see extra of them within the coming months,” he added.

Economists agree.

“Whereas the Fed is getting pressured to maneuver on charges, the US economic system is proving extra resilient than anticipated. The present consensus development forecast for the US in 2025 is down to only 1.4 p.c. Given the latest inflation studying of two.4 p.c, that will imply the bottom nominal development charge since 2020. The subsequent revision to US development might be increased, and that warrants ready,” Scott Helfstein, SVP, head of funding technique at World X instructed Al Jazeera.

“The roles quantity has constantly are available higher than anticipated. The Fed mandate is full employment and worth stability. Whereas the dangers to each have been elevated amid coverage uncertainty, weak point in labour or accelerating inflation is solely not displaying up within the knowledge. That’s the focus of the Fed calculus right here.”

“Fed Chair Jerome Powell has little urgency to ease. But when any easing had been to have occurred, it will have been massively stimulative, and would have lowered US debt curiosity expense,” Michael Ashley Schulman, accomplice and chief funding officer at Operating Level Capital Advisors, instructed Al Jazeera.

Policymakers are trying on the looming and constantly shifting adjustments to Trump’s tariff insurance policies in addition to the escalating tensions within the Center East. Whereas oil costs had been on the decline earlier than Israel’s assault final week on Iran and its retaliatory strikes, the considerations a few closure of the Strait of Hormuz as tensions escalate have fueled concerns that prices might go up within the coming weeks.

Trump criticises Powell

Earlier than the speed announcement, Trump expressed disappointment within the central financial institution’s choice to carry charges regular prior to now few months.

“Powell’s too late,” he mentioned, referring to his need for charge cuts. “I name him ‘too late Powell’ as a result of he’s at all times too late. I imply, if you happen to take a look at him, each time I did this I used to be proper 100%, he was unsuitable,” Trump mentioned.

He added that he “could need to pressure one thing” however it’s not clear what Trump meant by that.

He additionally prompt that he ought to lead the central financial institution. “Perhaps I ought to go to the Fed,” Trump mentioned. “Am I allowed to nominate myself on the Fed? I’d do a significantly better job than these individuals.”

Powell’s time period is about to run out subsequent Might, and Trump has just lately walked again his rhetoric on firing the central financial institution head.

“What I’m going to do is, you already know, he will get out in about 9 months, he has to, he will get fortuitously terminated … I’d have by no means reappointed him, [former President Joe] Biden reappointed him. I don’t know why that’s, however I suppose possibly he was a Democrat … he’s finished a poor job,” Trump mentioned.

On the information convention, Powell responded to the stream of assaults. “Every part we do is in service to our public mission,” he mentioned.